BNPL Cyber Monday 2025: $1.03 Billion Impact

Advertisements

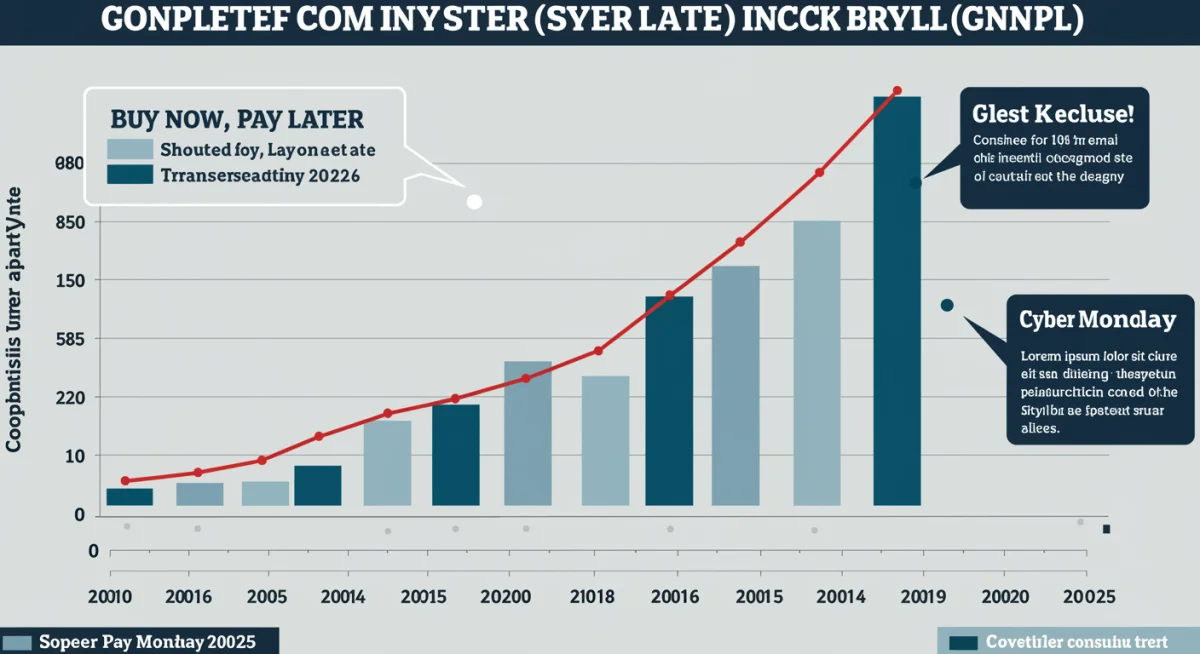

Buy Now, Pay Later (BNPL) services significantly propelled Cyber Monday 2025 sales, contributing an impressive $1.03 billion, demonstrating their pivotal role in modern consumer finance and e-commerce growth.

The digital shopping landscape is constantly evolving, and a major player in this transformation is the Buy Now, Pay Later (BNPL) model. On Cyber Monday 2025, this payment method proved its immense power, with BNPL services generated 1.03 billion dollars on Cyber Monday 2025, a figure that signals a seismic shift in consumer purchasing behavior. This remarkable achievement underscores the increasing reliance on flexible payment solutions, especially during peak shopping events, and offers a glimpse into the future of retail finance.

The Rise of BNPL: A New Era of Consumer Credit

The journey of Buy Now, Pay Later (BNPL) services from a niche payment option to a mainstream financial tool has been swift and impactful. These services offer consumers the flexibility to split purchases into smaller, interest-free installments, making high-value items more accessible and managing budgets easier. This convenience has resonated deeply with a broad demographic, particularly younger generations who may be wary of traditional credit cards or prefer more transparent payment structures.

The appeal of BNPL lies not only in its financial flexibility but also in its seamless integration into the online shopping experience. With just a few clicks, shoppers can complete their purchases, deferring payment without the immediate burden of interest, provided they adhere to the repayment schedule. This frictionless process has become a significant driver of conversion rates for retailers, especially during high-stakes sales events like Cyber Monday.

Understanding the BNPL Mechanism

At its core, BNPL operates on a simple premise: a third-party provider pays the merchant upfront for the consumer’s purchase, and the consumer then repays the provider over a set period, typically in four installments. This model benefits both consumers and merchants:

- For Consumers: It offers immediate gratification, budget management, and often, interest-free financing.

- For Merchants: It leads to increased average order values, reduced cart abandonment, and access to a broader customer base.

- For Providers: They earn revenue through merchant fees and late payment charges, if applicable.

The rapid adoption of BNPL is a testament to its effectiveness in meeting contemporary consumer demands. Its growth trajectory suggests that it is not merely a passing trend but a fundamental change in how people approach online transactions, particularly when seeking daily deals and discounts.

Cyber Monday 2025: A Landmark for Flexible Payments

Cyber Monday has long been a bellwether for e-commerce trends, and 2025 proved to be a pivotal moment for BNPL. The staggering $1.03 billion generated through these services on a single day speaks volumes about their integration into the holiday shopping fabric. This figure represents not just transactions but a shift in how consumers plan and execute their purchases during high-pressure sales periods.

Retailers who embraced BNPL as a core payment option reported significant gains in sales volume and customer engagement. The ability to spread out payments allowed shoppers to take advantage of attractive Cyber Monday deals without feeling the immediate financial strain, thus encouraging larger purchases and a more confident shopping experience. This symbiotic relationship between BNPL providers and retailers created a powerful economic engine.

Factors Contributing to BNPL’s Cyber Monday Success

Several key factors converged to make Cyber Monday 2025 such a resounding success for BNPL services:

- Increased Consumer Awareness: More consumers are now familiar with and trust BNPL options.

- Wider Merchant Adoption: A growing number of major retailers integrated BNPL into their checkout processes.

- Economic Pressures: Inflation and economic uncertainty made flexible payment options more appealing to budget-conscious shoppers.

- Targeted Marketing: BNPL providers and retailers collaborated on campaigns highlighting the benefits for holiday shopping.

The data from Cyber Monday 2025 clearly indicates that BNPL is no longer an ancillary payment method; it is a central component of successful e-commerce strategies, especially during peak sales events. Its ability to empower consumers while boosting retailer revenues makes it an undeniable force in the market.

Consumer Behavior and BNPL Adoption: A Deep Dive

Understanding why consumers gravitate towards BNPL reveals deeper insights into modern shopping psychology. The immediate gratification coupled with delayed financial commitment is a powerful combination. This is particularly true for larger purchases, where the option to pay in installments can be the deciding factor for completing a transaction. On Cyber Monday, where deals are fleeting and inventory can be limited, the speed and ease of BNPL checkout are invaluable.

Beyond convenience, BNPL appeals to a segment of consumers who are diligent about budgeting and avoiding high-interest debt. By offering interest-free installments, BNPL positions itself as a responsible alternative to traditional credit, especially for those who pay on time. This perception of financial prudence has bolstered its popularity among various demographics, from Gen Z to millennials and even older shoppers seeking more control over their finances.

Demographic Shifts and Spending Habits

The demographic profile of BNPL users is diverse, but certain trends are evident:

- Younger Generations: A significant portion of users are younger, digital-native consumers who prioritize convenience and transparency.

- Budget-Conscious Shoppers: Individuals looking to manage their cash flow effectively find BNPL appealing.

- Impulse Buyers: The ease of use can facilitate spontaneous purchases, especially during sales events.

The Cyber Monday 2025 figures underscore that BNPL is not just for small impulse buys; it’s increasingly being used for substantial purchases, demonstrating a growing trust in the model. This shift in consumer behavior is reshaping how retailers approach their sales strategies, focusing on flexible payment options as a key differentiator.

Retailer Strategies: Integrating BNPL for Maximized Sales

For retailers, the integration of BNPL services has moved beyond a mere option to a strategic imperative. Businesses that successfully leveraged BNPL on Cyber Monday 2025 saw a direct correlation with increased sales, higher average order values, and improved customer loyalty. The ability to offer a flexible payment solution at checkout reduces friction and empowers customers, making them more likely to complete a purchase.

Effective BNPL integration isn’t just about adding a button; it involves strategic placement, clear communication of benefits, and sometimes, exclusive deals tied to BNPL usage. Retailers are also finding that BNPL can be a powerful tool for customer acquisition, drawing in new shoppers who specifically seek out flexible financing options.

Best Practices for BNPL Integration

To maximize the benefits of BNPL, retailers are adopting several best practices:

- Prominent Placement: Displaying BNPL options clearly on product pages and at checkout.

- Transparent Terms: Ensuring customers fully understand the payment schedule and any potential fees.

- Marketing Collaboration: Partnering with BNPL providers for joint promotional campaigns.

- Data Analysis: Utilizing BNPL transaction data to understand customer preferences and optimize offerings.

The $1.03 billion generated on Cyber Monday 2025 serves as a powerful case study for retailers globally. It demonstrates that providing diverse, flexible payment solutions is no longer a luxury but a necessity for thriving in the competitive e-commerce landscape.

The Economic Implications of BNPL’s Growth

The significant contribution of BNPL to Cyber Monday 2025 sales has broader economic implications. It suggests a fundamental shift in how consumer credit functions and its impact on overall retail spending. While traditional credit cards still dominate, BNPL is carving out a substantial share, particularly in the e-commerce sector. This growth can stimulate economic activity by making goods more accessible, but it also raises questions about consumer debt and regulation.

The rapid expansion of BNPL services means more money flowing through the economy, supporting businesses and potentially creating jobs. However, policymakers and financial institutions are also scrutinizing the model to ensure consumer protection and responsible lending practices. The balance between fostering innovation and safeguarding consumers will be a key challenge as BNPL continues its upward trajectory.

Regulatory Landscape and Future Outlook

As BNPL services grow, so does the attention from regulatory bodies. Discussions around consumer credit reporting, transparency of terms, and potential fees are ongoing. The future of BNPL will likely involve a more formalized regulatory framework to ensure sustainable growth and protect consumers from potential pitfalls. Despite these evolving challenges, the outlook for BNPL remains overwhelmingly positive.

- Increased Competition: More players entering the market will drive innovation and potentially lower costs.

- Technological Advancements: Integration with AI and machine learning will personalize offerings and improve risk assessment.

- Global Expansion: BNPL is expected to continue its expansion into new international markets.

The Cyber Monday 2025 figures underscore BNPL’s economic significance, highlighting its role as a powerful engine for consumer spending and a catalyst for change in the financial sector. Its evolution will be closely watched by economists, retailers, and consumers alike.

Challenges and Opportunities in the BNPL Ecosystem

While the success of BNPL on Cyber Monday 2025 is undeniable, the ecosystem faces both challenges and significant opportunities. One primary challenge is the potential for consumers to overextend themselves, leading to missed payments and accumulating late fees. Responsible lending and clear communication from BNPL providers are crucial to mitigate these risks. Another challenge lies in regulatory uncertainty, as governments worldwide grapple with how to best oversee these relatively new financial products.

However, the opportunities are vast. For consumers, BNPL can be a valuable budgeting tool and a way to access goods and services without traditional credit hurdles. For retailers, it offers a proven method to boost sales, reduce cart abandonment, and attract a younger, tech-savvy demographic. The innovation within the BNPL space is also creating new financial products and services, pushing the boundaries of consumer finance.

Navigating the Future of Flexible Payments

The path forward for BNPL involves continuous innovation and a commitment to responsible practices. Providers are investing in:

- Enhanced Financial Literacy Tools: Helping consumers understand their commitments.

- Improved Risk Assessment: Leveraging data to make smarter lending decisions.

- Seamless User Experience: Further streamlining the checkout process.

The impressive $1.03 billion generated on Cyber Monday 2025 demonstrates BNPL’s strong market position and its potential for continued growth. Addressing the challenges proactively will ensure that BNPL remains a beneficial and sustainable force in the global economy, offering ever more opportunities for both consumers and businesses.

| Key Point | Brief Description |

|---|---|

| Cyber Monday 2025 Sales | BNPL services facilitated $1.03 billion in transactions, marking a significant milestone. |

| Consumer Adoption | Growing preference for flexible, interest-free installment payments among diverse demographics. |

| Retailer Benefits | Increased average order value, reduced cart abandonment, and broader customer reach. |

| Economic Impact | BNPL’s growth influences overall retail spending and prompts discussions on regulation. |

Frequently Asked Questions About BNPL and Cyber Monday 2025

BNPL, or Buy Now, Pay Later, allows consumers to make purchases and pay in installments, often interest-free. On Cyber Monday 2025, BNPL services generated an astounding $1.03 billion in sales, highlighting its significant impact on holiday shopping and consumer spending patterns.

Consumers are drawn to BNPL for its financial flexibility, allowing them to manage budgets effectively and make larger purchases without immediate full payment. The interest-free installment plans offer an appealing alternative to traditional credit, especially during high-stakes sales like Cyber Monday.

Retailers benefit from BNPL through increased average order values, reduced cart abandonment rates, and expanded customer reach. Offering flexible payment options at checkout encourages more purchases, especially for consumers seeking deals during competitive events like Cyber Monday.

BNPL’s rapid growth suggests a shift in consumer credit and spending habits, contributing significantly to e-commerce volumes. While it stimulates economic activity, it also prompts discussions on consumer debt, financial literacy, and the need for appropriate regulatory frameworks to ensure responsible use and protect consumers.

Challenges include potential consumer overextension and regulatory uncertainty. Opportunities involve continued innovation, enhanced financial literacy tools, improved risk assessment, and global expansion, ensuring BNPL remains a sustainable and beneficial financial tool for both consumers and businesses.

Conclusion

The remarkable achievement of BNPL services generating 1.03 billion dollars on Cyber Monday 2025 stands as a powerful testament to their transformative impact on modern retail and consumer finance. This figure is more than just a sales number; it signifies a profound shift in how consumers approach spending, especially during crucial shopping periods. As BNPL continues to evolve, addressing both its inherent opportunities and challenges will be paramount to ensuring its sustainable growth and its ongoing contribution to a dynamic and accessible e-commerce landscape. Retailers, consumers, and financial institutions alike must adapt to this new era of flexible payments, recognizing its potential to reshape economic interactions for years to come.